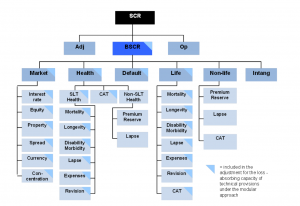

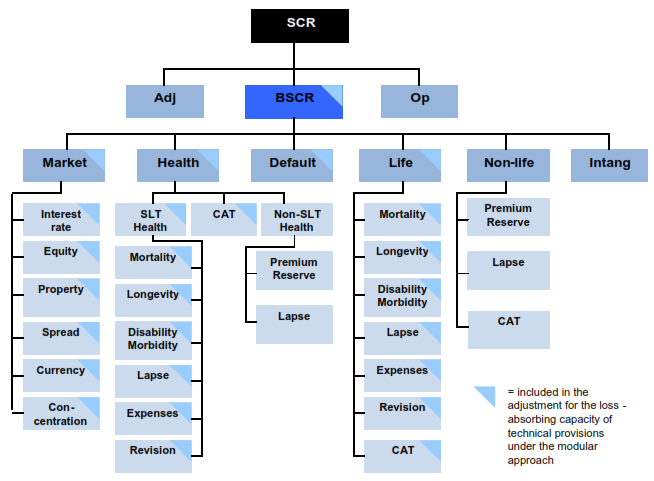

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

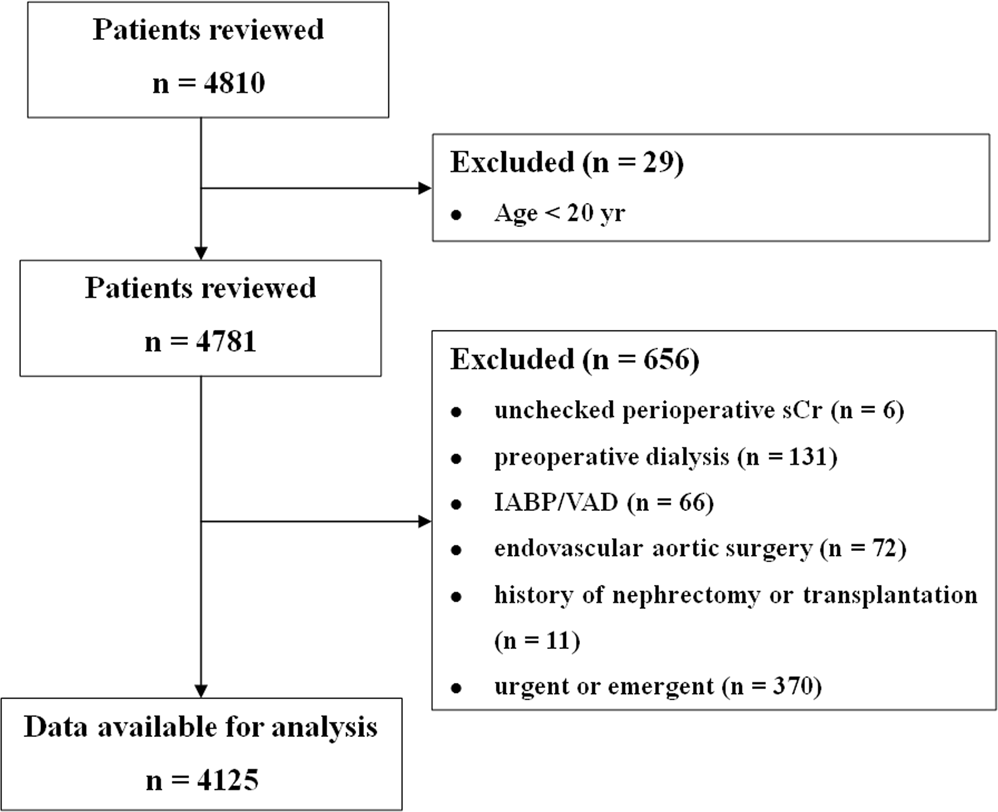

Comparison of five glomerular filtration rate estimating equations as predictors of acute kidney injury after cardiovascular surgery | Scientific Reports

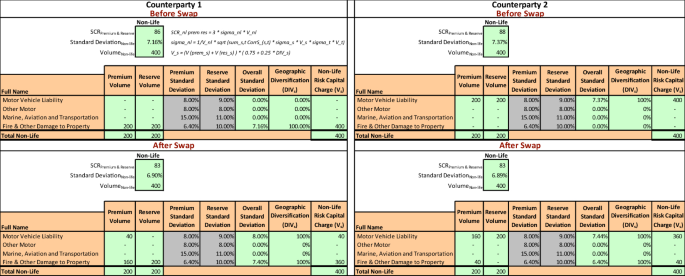

Diversification and Solvency II: the capital effect of portfolio swaps on non-life insurers | SpringerLink

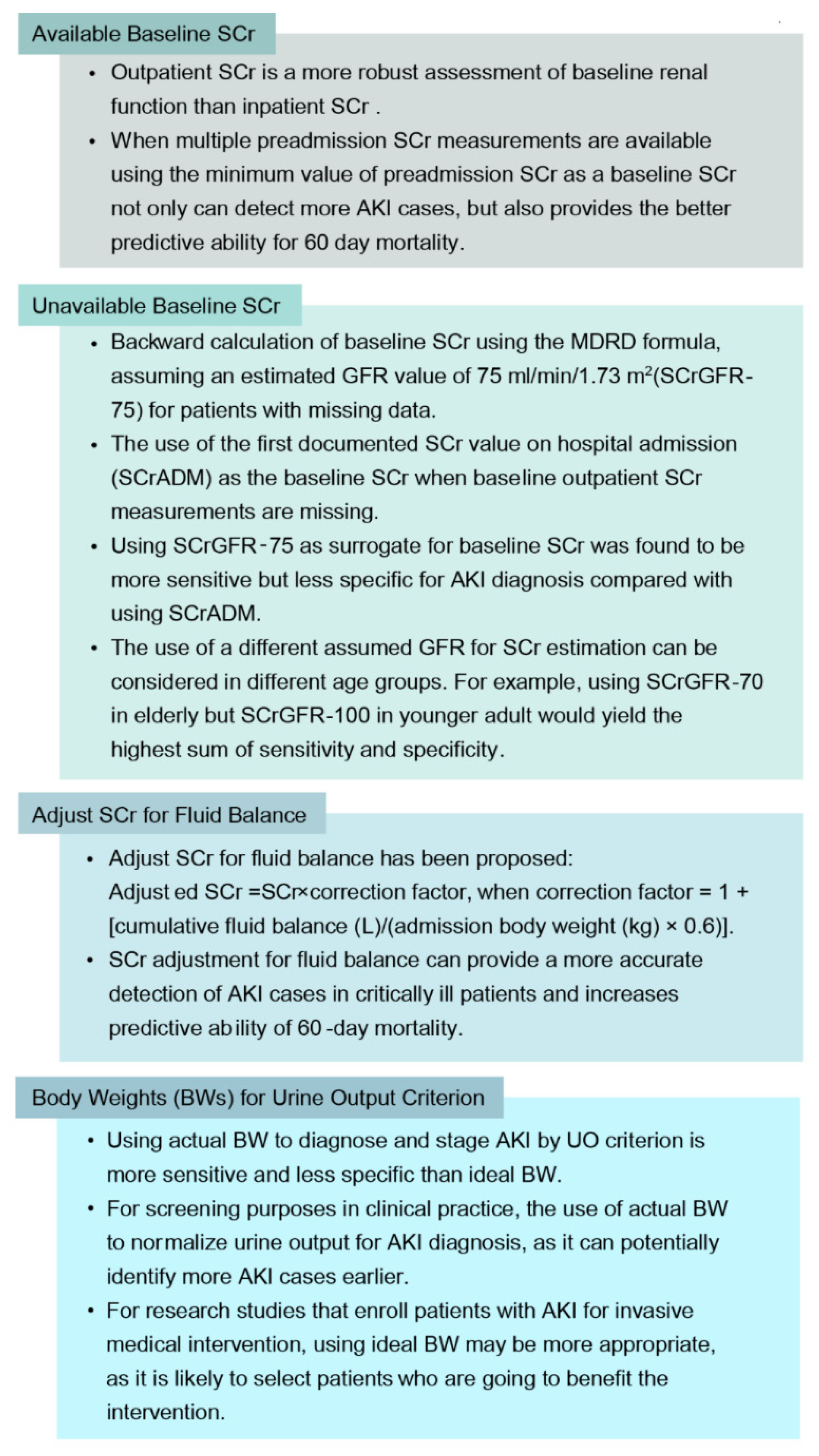

JCM | Free Full-Text | Diagnostics, Risk Factors, Treatment and Outcomes of Acute Kidney Injury in a New Paradigm

Mechanism of Standard NH3–SCR over Cu-CHA via NO+ and HONO Intermediates | The Journal of Physical Chemistry C